Hello everyone, today I have done a correlation analysis of Indian Bank stocks. I have compared major private and public banking stocks listed on the stock exchange. This is my first blog article sharing my analysis, please share it if you like it. Let's get right into it.

If you also want to do this analysis by yourself, you can check out my this other post regarding the same

I have looked back at data for the last 10 years since the date of writing this blog. I have compared stock price movements of the following major banking stocks

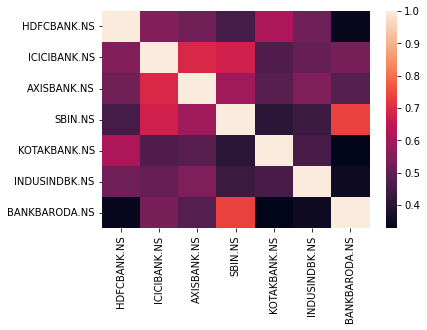

HDFCBANK, ICICIBANK, AXISBANK, SBIN, KOTAKBANK, INDUSINDBK, BANKBARODA

Below is the correlation matrix which we got for the data for the last 10 years

We can derive multiple observations from this data. Here are the mine:

- HDFC Bank is highly correlated with other private sector banks most prominently with Kotak bank.

- Similarly, SBI has a very high correlation with the Bank of Baroda which is the second major public sector bank.

- Interestingly, SBI has a high correlation with ICICI and AXIS bank.

- ICICI and AXIS bank has the highest correlation among private sector banks.

- HDFC Bank & Bank of Baroda and SBI & Kotak Bank have the lowest correlation, which seems alright.

- Indusind Bank doesn't seem to have any good correlation with any other banking stock.

Similarly, there can be many more observations that I might have missed, please write in the comment section for the same.

If you like what I write, please do share it on social media. Till next time, peace.!